WaveApps, the surprisingly user-friendly accounting software, is changing the game for small businesses. Forget clunky spreadsheets and confusing accounting jargon; WaveApps offers a streamlined approach to managing your finances, making it accessible even if you’re not a numbers whiz. We’ll explore its features, pricing, and overall effectiveness, comparing it to other popular options and uncovering hidden gems along the way.

Table of Contents

This deep dive will cover everything from invoicing and expense tracking to robust reporting and mobile app functionality. We’ll examine WaveApps’ strengths and weaknesses, explore its integrations, and even speculate on its future. Whether you’re a seasoned entrepreneur or just starting out, this guide will help you decide if WaveApps is the right fit for your business needs.

Waveapps Features Overview

Waveapps is a popular free accounting software designed for small businesses and freelancers. It offers a surprisingly robust suite of features considering its free plan, making it a compelling option for those just starting out or looking for a simple yet effective solution. This overview will detail Waveapps’ core functionalities, compare it to competitors, and categorize its features for easier understanding.

Core Functionalities of Waveapps

Waveapps provides a comprehensive set of tools for managing your business finances. At its core, it handles invoicing, expense tracking, and reporting. Beyond these basics, it integrates features like time tracking and receipt scanning, streamlining various aspects of financial management. The user interface is generally intuitive, making it relatively easy to learn and use, even for those with limited accounting experience.

This ease of use, combined with its powerful features, is a key factor in its popularity.

Feature Comparison with Competitors

Compared to competitors like QuickBooks Self-Employed or Xero, Waveapps stands out with its completely free plan. While competitors often offer free trials or limited free versions, Waveapps provides a fully functional free plan, albeit with limitations on features like support and advanced reporting for larger businesses. QuickBooks and Xero typically offer more sophisticated features for larger companies, including inventory management and more robust payroll capabilities.

However, for small businesses and freelancers, Waveapps often provides more than enough functionality without the hefty price tag. The trade-off is usually in the level of customer support and the depth of advanced features.

Categorized Waveapps Features

The following table organizes Waveapps’ key features into categories:

| Category | Feature | Description | Comparison to Competitors |

|---|---|---|---|

| Invoicing | Invoice Creation & Sending | Create professional invoices, track payments, and send them electronically. Supports various payment gateways. | Comparable to competitors, but lacks some advanced customization options found in paid plans of other software. |

| Expense Tracking | Receipt Scanning & Categorization | Easily scan receipts using your mobile device and automatically categorize expenses. | Similar functionality to competitors, though the OCR accuracy may vary. |

| Reporting | Profit & Loss, Balance Sheet, etc. | Generate basic financial reports to track your business’s financial health. | Offers basic reports, but lacks the advanced reporting and customization found in premium competitors. |

| Other Features | Time Tracking, Client Management | Track billable hours and manage client information. | Basic client management, time tracking is functional but lacks the advanced features of dedicated project management software. |

Waveapps Pricing and Plans

Waveapps offers a tiered pricing structure designed to cater to businesses of varying sizes and needs. Their plans range from a completely free option ideal for solopreneurs to more robust paid plans packed with features for growing companies. Understanding these different pricing tiers is key to choosing the plan that best fits your business’s budget and requirements.

Waveapps’ pricing model is straightforward, focusing on providing value at each level. The core functionality, including invoicing and accounting, is available for free, allowing users to explore the platform and determine if it aligns with their workflow. Paid plans unlock additional features and increase user limits, making them a worthwhile investment for businesses with more complex needs.

Waveapps Plan Details

Waveapps offers several plans, each with a distinct feature set and price point. The following breakdown clarifies the differences between them.

| Plan Name | Price | Key Features | Best For |

|---|---|---|---|

| Free | $0 | Basic invoicing, expense tracking, limited number of clients and transactions. | Freelancers, solopreneurs, and very small businesses with limited accounting needs. |

| Pro | (Pricing varies, check Waveapps website for current pricing) | Unlimited invoicing, expense tracking, more clients and transactions, advanced reporting, and potentially additional features like payroll (depending on the specific plan offered). | Small to medium-sized businesses needing more robust accounting and invoicing capabilities. |

| (If applicable) Premium/Enterprise | (Pricing varies, check Waveapps website for current pricing) | All features of the Pro plan, plus additional features tailored for larger businesses, potentially including advanced integrations, dedicated support, and higher transaction limits. | Larger businesses with complex accounting needs and a higher volume of transactions. |

User Experience and Interface

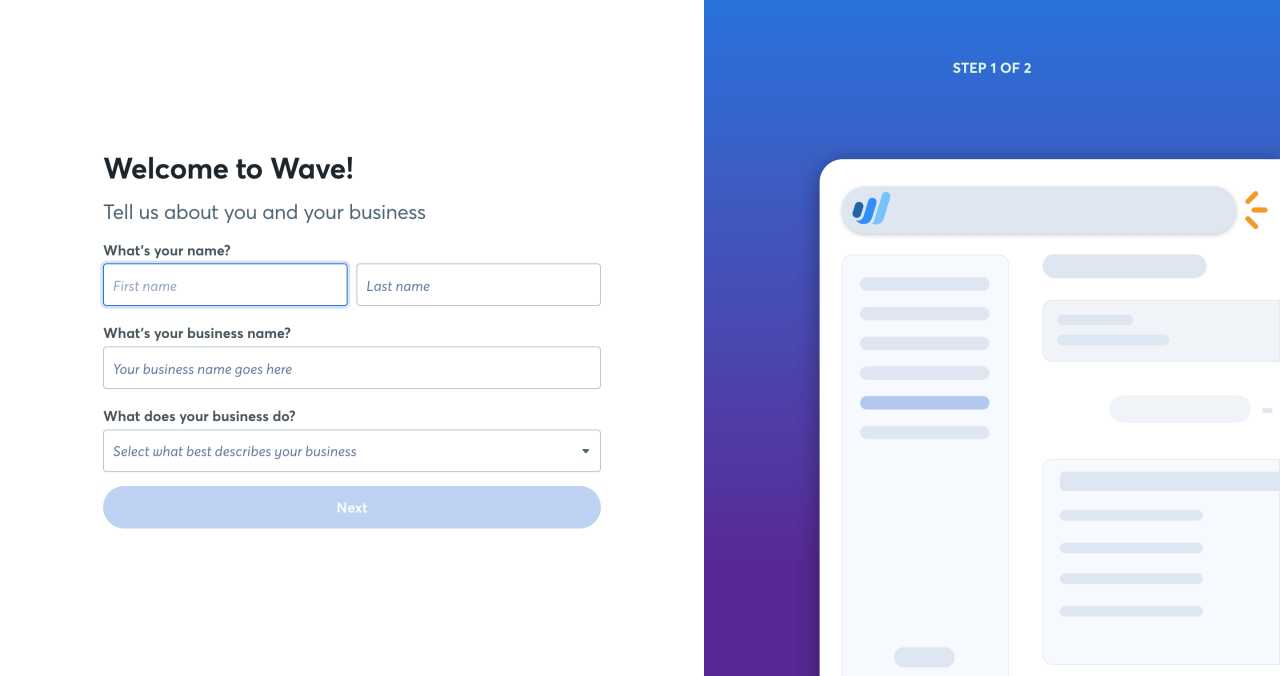

Waveapps boasts a relatively intuitive interface, aiming for simplicity and ease of use, particularly for small businesses and freelancers. However, the actual user experience can vary depending on the user’s technical proficiency and familiarity with accounting software. The design choices reflect a focus on accessibility, but some aspects could benefit from further refinement.The Waveapps interface presents a clean and uncluttered dashboard.

Information is generally well-organized, with key metrics prominently displayed. The navigation is largely straightforward, using a menu system that allows users to access different modules (invoicing, accounting, payments, etc.) with minimal clicks. Color schemes are consistent and generally pleasing to the eye, contributing to a positive initial impression.

Dashboard and Navigation

The main dashboard provides a quick overview of crucial financial data, such as outstanding invoices, upcoming payments, and current account balances. This centralized view allows users to quickly assess their financial health without navigating through multiple menus. Navigation between different sections of the application is generally smooth and efficient, though users might occasionally find themselves needing to click through several layers to reach a specific setting or report.

The search functionality, while present, could be improved to offer more comprehensive results.

Ease of Use and Learning Curve

Waveapps is designed to be user-friendly, and for many users, this holds true. The platform’s intuitive design and straightforward functionality make it relatively easy to learn, even for those with limited accounting experience. However, users new to accounting software may still require some time to familiarize themselves with the terminology and processes. Comprehensive help documentation and video tutorials are available, which significantly reduce the learning curve for most users.

Nevertheless, some advanced features might present a steeper learning curve for less tech-savvy individuals.

Overall User Experience

The overall user experience with Waveapps is generally positive. Many users appreciate its simplicity, ease of use, and accessibility. The clean interface and straightforward navigation contribute to a smooth workflow. However, some users have expressed concerns about the lack of customization options and the occasional limitations in reporting features. While the platform effectively handles basic accounting tasks, more complex operations might require more effort than in some competitor applications.

For example, integrating Waveapps with other business tools can sometimes be more challenging than expected, and customer support response times, while adequate, aren’t always instantaneous.

Waveapps Integrations

Waveapps boasts a pretty solid suite of integrations, making it a versatile platform for small businesses. These integrations allow you to connect Waveapps with other apps you already use, streamlining your workflow and eliminating the need to manually transfer data between different systems. This ultimately saves you time and reduces the risk of errors.Connecting Waveapps to other apps can significantly boost efficiency.

For example, integrating with your e-commerce platform automatically imports sales data into Waveapps, eliminating the tedious task of manual entry. Similarly, integrating with your payroll software simplifies the process of paying your employees. The seamless flow of information between apps makes managing your finances a much smoother process.

Popular Waveapps Integrations and Their Functionalities

The power of Waveapps truly shines when you leverage its integration capabilities. Here’s a rundown of some popular integrations and what they bring to the table:

- Shopify: This integration automatically syncs your Shopify sales data with Waveapps, providing a real-time view of your revenue and expenses. No more manual data entry – just a streamlined flow of information directly into your accounting software.

- PayPal: Seamlessly connect your PayPal account to Waveapps to automatically reconcile your online payments. This integration eliminates the need to manually input transactions, saving you valuable time and minimizing the potential for errors.

- Xero: While not a direct integration, many users utilize third-party tools to migrate data between Waveapps and Xero, offering a flexible solution for those needing to switch accounting platforms. This demonstrates the adaptability of Waveapps within the broader accounting ecosystem.

- Stripe: Similar to the PayPal integration, Stripe integration allows for automated reconciliation of online payments processed through the Stripe platform. This simplifies financial reporting and reduces the administrative burden.

- Square: For businesses using Square for point-of-sale transactions, this integration allows for the automatic import of sales data into Waveapps. This real-time data flow provides an accurate and up-to-date picture of your business’s financial performance.

Waveapps Security and Data Privacy

Protecting your data is a top priority for Waveapps. We understand that your financial information is sensitive, and we’ve implemented robust security measures to safeguard it. Our commitment to data privacy is reflected in our policies and practices, ensuring compliance with relevant regulations.Waveapps employs a multi-layered approach to security, combining technical safeguards with strong operational practices. This includes using encryption to protect data both in transit and at rest, regular security audits to identify and address vulnerabilities, and rigorous access control measures to limit who can view and modify your data.

We also invest in ongoing security research and development to stay ahead of emerging threats.

Data Encryption

Waveapps utilizes industry-standard encryption protocols, such as TLS/SSL, to protect data transmitted between your computer and our servers. This ensures that your data remains confidential during transfer. Additionally, data stored on our servers is encrypted at rest using robust encryption algorithms to prevent unauthorized access even if a breach were to occur. This two-pronged approach minimizes the risk of data exposure.

Access Control and Authentication

Access to your Waveapps account is secured through strong password requirements and multi-factor authentication (MFA) options. MFA adds an extra layer of security by requiring a second form of verification, such as a code sent to your phone or email, in addition to your password. This makes it significantly harder for unauthorized individuals to gain access to your account, even if they obtain your password.

Internal access to data is also strictly controlled through role-based access controls, limiting access to only those who need it for their job responsibilities.

Data Privacy Policy

Waveapps’ data privacy policy Artikels how we collect, use, and protect your personal and financial data. It clearly states the types of data we collect, the purposes for which we collect it, and your rights regarding your data. This policy is readily available on our website and is updated regularly to reflect changes in our practices or relevant regulations.

We are transparent about our data collection and usage practices, aiming for complete user understanding and control over their information. The policy also details how we handle data requests, including access, correction, and deletion requests.

Compliance with Data Protection Regulations

Waveapps is committed to complying with all relevant data protection regulations, including GDPR (General Data Protection Regulation) and CCPA (California Consumer Privacy Act). We maintain rigorous internal processes and procedures to ensure compliance, regularly reviewing and updating our practices to meet evolving legal requirements. This commitment extends to our data processing practices and our interactions with users regarding their data rights.

We actively monitor regulatory changes and adapt our practices to ensure ongoing compliance.

Waveapps Customer Support

Navigating the world of accounting software can be tricky, and sometimes you need a helping hand. That’s where robust customer support comes in, and Waveapps’ offerings in this area are a key factor in determining its overall value. Let’s delve into the various ways Waveapps assists its users and how their support stacks up against competitors.Waveapps offers several channels for customer support, ensuring users can access help in a way that suits their preferences and technical comfort levels.

This multi-faceted approach is designed to provide quick solutions and address a wide range of user needs, from simple questions to complex technical issues.

Available Support Channels

Waveapps primarily relies on a comprehensive knowledge base and a ticketing system for customer support. Their online help center is packed with articles, FAQs, tutorials, and video guides covering a broad spectrum of topics. This self-service approach empowers users to troubleshoot many common issues independently. For more complex problems or situations requiring direct interaction, users can submit support tickets through the Waveapps website.

Response times vary, but generally, users report receiving a response within a reasonable timeframe. While phone support isn’t directly offered, the extensive online resources often preempt the need for it.

Responsiveness and Helpfulness of Waveapps Support

User experiences with Waveapps’ customer support are generally positive, though anecdotal. Many users praise the comprehensiveness of the online help center, finding answers to their questions quickly and efficiently. Those who have needed to submit tickets report varying response times depending on the complexity of the issue and the time of year. However, the general consensus suggests that support agents are knowledgeable and helpful, providing clear and effective solutions.

Some users mention that the self-service resources are so thorough that they rarely need to contact support directly.

Waveapps is awesome for managing your biz, right? But sometimes you need to show off your Waveapps dashboards in a killer presentation. That’s where a great mockup comes in handy; check out this sweet mockup generator to create professional-looking visuals. Then, you can easily impress clients with your polished Waveapps workflow.

Comparison to Competitor Support

Compared to competitors like Xero or QuickBooks, Waveapps’ support model differs significantly. Xero and QuickBooks often offer phone support in addition to online resources, providing a more immediate avenue for assistance. However, Waveapps’ extensive knowledge base and responsive ticketing system often mitigate the need for phone support, offering a viable alternative for many users. The effectiveness of each approach depends heavily on individual user preferences and the nature of the issue at hand.

While some users might prefer the immediacy of a phone call, others may find the self-service approach of Waveapps to be more efficient and convenient. Ultimately, the “best” support model is subjective and depends on individual needs.

Waveapps for Different Business Sizes

Waveapps, with its suite of accounting and financial management tools, offers a scalable solution adaptable to businesses of varying sizes. Its intuitive interface and straightforward functionality make it accessible to smaller operations, while its robust features and integration capabilities cater to the complexities of larger enterprises. Let’s examine how Waveapps’ effectiveness varies across different business scales.

The core functionality of Waveapps remains consistent regardless of business size. However, the

-extent* to which different features are utilized and the overall impact on business operations will differ significantly.

Waveapps Suitability for Small Businesses

Waveapps is a particularly strong fit for small businesses and startups. Its free plan provides a solid foundation for basic accounting needs, including invoicing, expense tracking, and financial reporting. Small businesses often appreciate the ease of use and the lack of a steep learning curve. For example, a freelance graphic designer could easily use Waveapps to track client invoices, manage expenses related to software subscriptions and supplies, and generate simple profit and loss statements.

The simple interface minimizes the time investment required for accounting, allowing owners to focus on their core business activities.

Waveapps Suitability for Medium-Sized Businesses

As businesses grow beyond the very basic needs, they might opt for a paid Waveapps plan. These plans unlock additional features such as advanced reporting, inventory management, and more robust collaboration tools. A medium-sized retail business, for instance, could utilize Waveapps to manage inventory levels, track sales data from multiple locations, and generate detailed financial reports for better decision-making.

The ability to manage multiple users and projects becomes increasingly valuable at this scale.

Waveapps Suitability for Large Corporations

While Waveapps provides a solid foundation, it may not be the ideal solution for large corporations with incredibly complex financial structures and extensive reporting requirements. These businesses often require enterprise-level accounting software with more sophisticated features and integrations. However, Waveapps could potentially be used within specific departments of a large corporation, perhaps for smaller projects or subsidiary operations where its simpler interface and cost-effectiveness are advantageous.

Imagine a large company using Waveapps to manage the accounting for a newly launched product line, separate from their main accounting system.

Comparative Analysis of Waveapps Across Business Sizes

| Feature | Small Business | Medium-Sized Business | Large Corporation |

|---|---|---|---|

| Invoicing | Highly Effective | Highly Effective | Potentially Effective (for specific projects) |

| Expense Tracking | Highly Effective | Highly Effective | Potentially Effective (for specific projects) |

| Financial Reporting | Effective | Highly Effective | Limited Effectiveness; Requires supplementary systems |

| Inventory Management | Limited Effectiveness | Effective | Ineffective; Requires dedicated enterprise software |

| Payroll | Limited Effectiveness (requires integrations) | Limited Effectiveness (requires integrations) | Ineffective; Requires dedicated payroll software |

| User Collaboration | Effective | Highly Effective | Limited Effectiveness; Requires more advanced collaboration tools |

| Integration Capabilities | Sufficient | Sufficient | Insufficient for complex integrations |

| Cost-Effectiveness | Excellent | Good | Limited Cost-Effectiveness |

Waveapps Mobile App Functionality

Waveapps’ mobile app aims to bring the core functionality of its desktop platform to your smartphone or tablet, allowing for convenient business management on the go. While not a complete mirror of the desktop version, it provides access to crucial features designed for quick checks and essential tasks. This allows users to stay connected to their financial data and perform key actions without needing to be tethered to a computer.The mobile app experience offers a streamlined interface compared to the desktop version.

The design prioritizes ease of navigation and quick access to frequently used features. While the desktop version offers more granular control and advanced features, the mobile app prioritizes a user-friendly experience focused on efficiency and speed. This approach means that some advanced features available on the desktop are omitted, but the core functionalities remain accessible and easy to use.

Feature Comparison: Mobile vs. Desktop

The Waveapps mobile app provides access to key features like viewing account balances, checking recent transactions, and creating and sending invoices. However, more complex tasks like advanced reporting or managing multiple complex accounting entries are often better suited to the desktop interface. The mobile app excels at providing quick access to critical information and facilitating simple actions, while the desktop version provides the depth and breadth needed for detailed financial management.

Think of it like this: the mobile app is your quick-access toolkit, while the desktop version is your comprehensive workshop.

Usability and Effectiveness for On-the-Go Management

The Waveapps mobile app’s usability is generally considered high, particularly for its intended purpose: quick access to essential financial information and streamlined task completion. The intuitive interface and simplified navigation make it easy to check account balances, review recent transactions, and approve payments, even for users unfamiliar with the platform. Its effectiveness is most apparent when dealing with urgent situations or when quick financial overviews are needed.

For example, a freelancer could quickly check if a payment has been received before responding to a client, or a small business owner can easily approve an expense while traveling. However, users needing to perform complex accounting tasks or detailed analysis will likely find the desktop application more suitable. The mobile app shines in its ability to provide essential financial information and facilitate quick actions, but it is not a replacement for the full desktop experience.

Waveapps Reporting and Analytics

Waveapps offers a robust suite of reporting and analytics tools designed to give you a clear picture of your business’s financial health. Whether you’re tracking income, expenses, or profitability, Waveapps provides the data you need to make informed decisions and optimize your operations. Understanding these reports is key to leveraging Waveapps’ full potential.Waveapps reporting features empower businesses to track financial performance by providing a centralized location for all financial data.

This eliminates the need to manually consolidate information from various sources, saving time and reducing the risk of errors. The reports are easily customizable, allowing you to focus on the key metrics that are most relevant to your business. This allows for both reactive adjustments to address immediate issues and proactive strategies for long-term growth.

Types of Reports Available in Waveapps

Waveapps offers a variety of pre-built reports, including income statements, balance sheets, cash flow statements, and sales tax reports. These reports provide a comprehensive overview of your financial performance, allowing you to identify trends and areas for improvement. Beyond these standard reports, Waveapps also allows for the creation of custom reports tailored to specific needs, offering a high degree of flexibility in data analysis.

For example, a user could create a custom report focusing solely on specific expense categories to track spending trends more precisely.

Tracking Financial Performance with Waveapps Reporting

Waveapps’ reporting tools provide a real-time view of your business’s financial performance. By regularly reviewing these reports, you can identify areas where you’re excelling and areas that need attention. For instance, a consistent decline in a specific revenue stream might signal the need for a marketing campaign or a product adjustment. Similarly, an unexpected spike in expenses can prompt an investigation to identify and address the cause.

This proactive approach allows for timely intervention, preventing minor issues from escalating into major problems.

Key Insights from Waveapps Reporting Tools

Understanding the key insights gleaned from Waveapps reporting tools is crucial for effective business management. Here are some of the benefits:

- Profitability Analysis: Easily track revenue, expenses, and profit margins to identify profitable and unprofitable products or services.

- Cash Flow Monitoring: Monitor cash inflows and outflows to ensure sufficient funds for operations and avoid cash flow shortages. This is particularly useful for predicting and managing periods of low revenue or high expenditure.

- Expense Tracking: Identify and analyze expense categories to pinpoint areas where costs can be reduced. This could include tracking marketing spend to measure ROI or reviewing subscription services for potential cost savings.

- Sales Performance: Track sales trends, identify top-performing products, and pinpoint areas needing improvement in sales strategies. For example, a user could track sales by region to determine where to focus marketing efforts.

- Tax Preparation: Generate reports for tax preparation, simplifying the process and reducing the risk of errors. This feature helps ensure compliance with tax regulations and minimizes potential penalties.

Waveapps’ Strengths and Weaknesses

Waveapps, like any software, boasts a set of compelling advantages alongside areas ripe for improvement. Understanding both its strengths and weaknesses is crucial for businesses considering adopting this accounting platform. This section will delve into a detailed analysis of Waveapps’ capabilities and limitations, offering a balanced perspective for informed decision-making.

Key Strengths of Waveapps

Waveapps shines in several key areas, making it an attractive option for many small businesses and freelancers. Its free plan, coupled with its user-friendly interface, contributes significantly to its popularity. Furthermore, its robust integrations and reporting features add to its overall appeal.

| Strength | Explanation |

|---|---|

| Free Plan with Core Features | Waveapps offers a comprehensive free plan including invoicing, expense tracking, and basic reporting. This is a huge draw for startups and small businesses with limited budgets. The free plan allows users to experience the core functionality before committing to a paid subscription. |

| Intuitive and User-Friendly Interface | The platform’s design prioritizes simplicity and ease of use. Navigation is straightforward, making it accessible even for users with limited accounting experience. This minimizes the learning curve and allows users to quickly become productive. |

| Robust Integrations | Waveapps seamlessly integrates with various popular business tools, including PayPal, Stripe, and Square. This streamlines financial processes by centralizing data from multiple sources. This integration simplifies reconciliation and reduces manual data entry. |

| Comprehensive Reporting | Waveapps generates various reports, including profit and loss statements, balance sheets, and cash flow statements. These reports provide valuable insights into business performance, aiding in informed decision-making. The ability to customize reports further enhances their utility. |

Key Weaknesses of Waveapps

While Waveapps offers many advantages, certain areas could benefit from improvement. Some limitations become more apparent as a business grows and its accounting needs become more complex. Scalability and support are key areas where Waveapps could enhance its offerings.

| Weakness | Explanation |

|---|---|

| Limited Scalability for Large Businesses | Waveapps is best suited for small businesses and freelancers. As a business grows and its transactions increase, the platform’s limitations might become more apparent. More advanced features and customization options may be necessary, which Waveapps might not fully provide. |

| Customer Support Could Be Improved | While Waveapps offers support resources, some users have reported challenges in accessing timely and effective assistance. Improved response times and more comprehensive support channels could enhance user experience. The free plan naturally receives less priority in support. |

| Inventory Management Limitations | Waveapps’ inventory management features are relatively basic. Businesses with extensive inventory needs might find the platform lacking in advanced inventory tracking and management capabilities. This is a common limitation in many small business accounting solutions. |

| Lack of Advanced Accounting Features | Waveapps might not cater to businesses requiring advanced accounting features like multi-currency support or complex accounting methodologies. Businesses with international operations or intricate financial structures may find the platform insufficient. |

Future of Waveapps

Waveapps, already a popular choice for small businesses, has a bright future brimming with potential for growth and innovation. Its current strengths, combined with emerging technological trends, suggest a trajectory of enhanced functionality and broader market reach. Several key areas are ripe for development, promising to solidify Waveapps’ position as a leading accounting and business management platform.Waveapps’ future development will likely focus on enhancing user experience, expanding integrations, and leveraging AI and machine learning.

The company could also explore new market segments and further refine its pricing strategy to accommodate a wider range of business needs.

Enhanced AI-Powered Features

The integration of more sophisticated AI capabilities could significantly improve Waveapps’ functionality. Imagine an AI-powered assistant that automatically categorizes transactions, predicts cash flow, and even suggests optimal tax strategies. This would free up valuable time for business owners, allowing them to focus on core business activities rather than tedious data entry and analysis. Similar to how Xero has implemented AI-driven insights, Waveapps could develop predictive analytics tools that provide proactive recommendations based on a business’s financial data.

For example, the system could alert users to potential cash flow shortages or identify opportunities for cost savings.

Improved Mobile App Experience

While Waveapps already offers a mobile app, further improvements could significantly boost user engagement and productivity. This could include offline access to key data, enhanced mobile-specific features like simplified invoice creation and approval workflows, and better integration with mobile payment systems. Consider the success of mobile-first banking apps; Waveapps could learn from this trend by optimizing its mobile app to be as intuitive and efficient as possible.

A streamlined user interface, tailored for smaller screens, would significantly improve the mobile experience.

Expanded Integrations and API Capabilities

A wider range of integrations with popular business applications would make Waveapps even more versatile. This could include deeper connections with e-commerce platforms, CRM systems, and project management tools. Expanding the API capabilities would also allow third-party developers to create custom integrations, further extending Waveapps’ functionality and catering to niche business requirements. For instance, integrating with popular project management tools like Asana or Trello could allow for seamless tracking of project costs and profitability.

This would be a significant advantage over competitors lacking such comprehensive integration capabilities.

Advanced Reporting and Analytics

The current reporting features could be enhanced to provide more insightful and customizable dashboards. This could include interactive charts and graphs, the ability to create custom reports based on specific business needs, and advanced data visualization tools. This would help businesses gain a clearer understanding of their financial performance and make data-driven decisions more easily. For example, users could create customized reports to track key performance indicators (KPIs) relevant to their industry, such as customer acquisition cost or average order value.

The ability to generate these reports in various formats, including PDF and CSV, would further enhance usability.

Closure

Ultimately, WaveApps presents a compelling option for small businesses and freelancers seeking a straightforward, affordable, and surprisingly powerful accounting solution. While it might not be the perfect fit for every enterprise, its intuitive design, robust features, and excellent free plan make it a strong contender in a crowded market. The user-friendly interface and valuable integrations are major selling points, offsetting some minor limitations.

If you’re looking for a hassle-free way to manage your finances, WaveApps definitely warrants a closer look.

FAQ Overview

Is WaveApps suitable for large corporations?

Probably not. WaveApps is best suited for small businesses and freelancers. Larger corporations often require more complex accounting features and integrations.

Does WaveApps offer customer support in multiple languages?

Check their website for the most up-to-date information on language support. This can change.

What types of payment methods does WaveApps accept?

They typically accept major credit cards and potentially other methods – best to check their website for the most current options.

Can I export my data from WaveApps?

Yes, WaveApps allows data export, usually in common formats like CSV. Check their help section for specifics.

Is there a free trial available?

They offer a free plan with limited features, which is a good way to test it out before committing to a paid plan.